CEO IR NEWSLETTER Driven. For Life.

SAMSUNG BIOLOGICS 2023.10

Dear investors, This is John Rim from Samsung Biologics. First of all, I would like to express my sincere gratitude and appreciation towards your continued interest and ongoing trust in Samsung Biologics.

Key Highlights

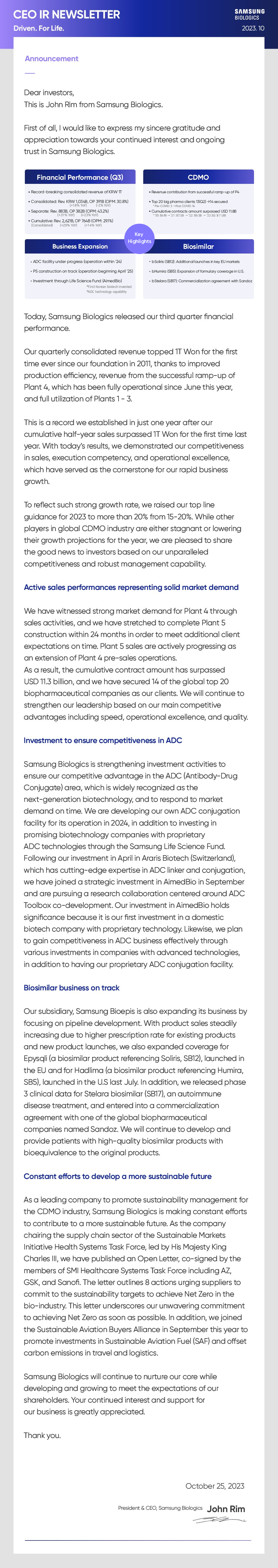

- Financial Performance (Q3)

- . Record-breaking consolidated revenue of KRW TT . Consolidated: Rev. KRW 1,034B(+18% YoY), OP 391B (-2% YoY)(OPM: 30.8%) · Separate: Rev. 883B(+31% YoY), OP 382B (+23% YoY)(OPM: 43.2%) · Cumulative: Rev. 2,621B(+29% YoY), OP 764B (+14% YoY)(OPM: 29.1%)

- CDMO

- . Revenue contribution from successful ramp-up of P4 . Top 20 big pharma clients 13(Q2) >14 secured *Pre-COVID: 3 -Post COVID: 14 . Cumulative contracts amount surpassed USD 11.8B *'20:$6.1B -'21:$7.5B +'22: $9.5B -+'23 3Q: $11.8B

- Business Expansion

- . ADC facility under progress (operation within '24) . P5 construction on track (operation beginning April '25) . Investment through Life Science Fund (AimedBio) *First Korean biotech invested *ADC technology capability

- Biosimilar

- . bSoliris (SB12): Additional launches in key EU markets . bHumira (SB5): Expansion of formulary coverage in U.S. . bStelara (SB17): Commercialization agreement with Sandoz

Today, Samsung Biologics released our third quarter financial performance. Our quarterly consolidated revenue topped 1T Won for the first time ever since our foundation in 2011, thanks to improved production efficiency, revenue from the successful ramp-up of Plant 4, which has been fully operational since June this year, and full utilization of Plants 1 - 3. This is a record we established in just one year after our cumulative half-year sales surpassed 1T Won for the first time last year. With today's results, we demonstrated our competitiveness in sales, execution competency, and operational excellence, which have served as the cornerstone for our rapid business growth. To reflect such strong growth rate, we raised our top line guidance for 2023 to more than 20% from 15-20%. While other players in global CDMO industry are either stagnant or lowering their growth projections for the year, we are pleased to share the good news to investors based on our unparalleled competitiveness and robust management capability.

Active sales performances representing solid market demand

We have witnessed strong market demand for Plant 4 through sales activities, and we have stretched to complete Plant 5 construction within 24 months in order to meet additional client expectations on time. Plant 5 sales are actively progressing as an extension of Plant 4 pre-sales operations. As a result, the cumulative contract amount has surpassed USD 11.3 billion, and we have secured 14 of the global top 20 biopharmaceutical companies as our clients. We will continue to strengthen our leadership based on our main competitive advantages including speed, operational excellence, and quality.

Investment to ensure competitiveness in ADC

Samsung Biologics is strengthening investment activities to ensure our competitive advantage in the ADC (Antibody-Drug Conjugate) area, which is widely recognized as the next-generation biotechnology, and to respond to market demand on time. We are developing our own ADC conjugation facility for its operation in 2024, in addition to investing in promising biotechnology companies with proprietary ADC technologies through the Samsung Life Science Fund. Following our investment in April in Araris Biotech (Switzerland), which has cutting-edge expertise in ADC linker and conjugation, we have joined a strategic investment in AimedBio in September and are pursuing a research collaboration centered around ADC Toolbox co-development. Our investment in AimedBio holds significance because it is our first investment in a domestic biotech company with proprietary technology. Likewise, we plan to gain competitiveness in ADC business effectively through various investments in companies with advanced technologies, in addition to having our proprietary ADC conjugation facility.

Biosimilar business on track

Our subsidiary, Samsung Bioepis is also expanding its business by focusing on pipeline development. With product sales steadily increasing due to higher prescription rate for existing products and new product launches, we also expanded coverage for Epysqli (a biosimilar product referencing Soliris, SB12), launched in the EU and for Hadlima (a biosimilar product referencing Humira, SB5), launched in the U.S last July. In addition, we released phase 3 clinical data for Stelara biosimilar (SB17), an autoimmune disease treatment, and entered into a commercialization agreement with one of the global biopharmaceutical companies named Sandoz. We will continue to develop and provide patients with high-quality biosimilar products with bioequivalence to the original products.

Constant efforts to develop a more sustainable future

As a leading company to promote sustainability management for the CDMO industry, Samsung Biologics is making constant efforts to contribute to a more sustainable future. As the company chairing the supply chain sector of the Sustainable Markets Initiative Health Systems Task Force, led by His Majesty King Charles III, we have published an Open Letter, co-signed by the members of SMI Healthcare Systems Task Force including AZ, GSK, and Sanofi. The letter outlines 8 actions urging suppliers to commit to the sustainability targets to achieve Net Zero in the bio-industry. This letter underscores our unwavering commitment to achieving Net Zero as soon as possible. In addition, we joined the Sustainable Aviation Buyers Alliance in September this year to promote investments in Sustainable Aviation Fuel (SAF) and offset carbon emissions in travel and logistics. Samsung Biologics will continue to nurture our core while developing and growing to meet the expectations of our shareholders. Your continued interest and support for our business is greatly appreciated. Thank you.

October 25, 2023 President & CEO, Samsung Biologics John Rim

CEO IR NEWSLETTER Driven. For Life.

SAMSUNG BIOLOGICS 2023.10

Dear investors, This is John Rim from Samsung Biologics. First of all, I would like to express my sincere gratitude and appreciation towards your continued interest and ongoing trust in Samsung Biologics.

Key Highlights

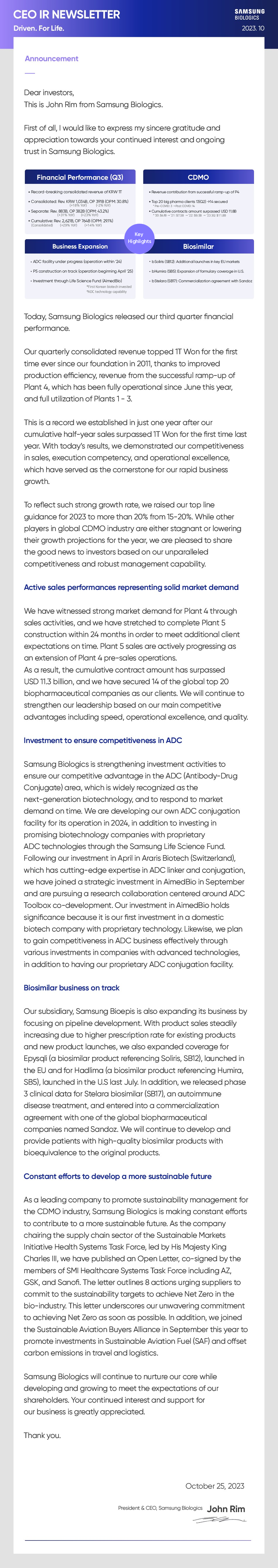

- Financial Performance (Q3)

- . Record-breaking consolidated revenue of KRW TT . Consolidated: Rev. KRW 1,034B(+18% YoY), OP 391B (-2% YoY)(OPM: 30.8%) · Separate: Rev. 883B(+31% YoY), OP 382B (+23% YoY)(OPM: 43.2%) · Cumulative: Rev. 2,621B(+29% YoY), OP 764B (+14% YoY)(OPM: 29.1%)

- CDMO

- . Revenue contribution from successful ramp-up of P4 . Top 20 big pharma clients 13(Q2) >14 secured *Pre-COVID: 3 -Post COVID: 14 . Cumulative contracts amount surpassed USD 11.8B *'20:$6.1B -'21:$7.5B +'22: $9.5B -+'23 3Q: $11.8B

- Business Expansion

- . ADC facility under progress (operation within '24) . P5 construction on track (operation beginning April '25) . Investment through Life Science Fund (AimedBio) *First Korean biotech invested *ADC technology capability

- Biosimilar

- . bSoliris (SB12): Additional launches in key EU markets . bHumira (SB5): Expansion of formulary coverage in U.S. . bStelara (SB17): Commercialization agreement with Sandoz

Today, Samsung Biologics released our third quarter financial performance. Our quarterly consolidated revenue topped 1T Won for the first time ever since our foundation in 2011, thanks to improved production efficiency, revenue from the successful ramp-up of Plant 4, which has been fully operational since June this year, and full utilization of Plants 1 - 3. This is a record we established in just one year after our cumulative half-year sales surpassed 1T Won for the first time last year. With today's results, we demonstrated our competitiveness in sales, execution competency, and operational excellence, which have served as the cornerstone for our rapid business growth. To reflect such strong growth rate, we raised our top line guidance for 2023 to more than 20% from 15-20%. While other players in global CDMO industry are either stagnant or lowering their growth projections for the year, we are pleased to share the good news to investors based on our unparalleled competitiveness and robust management capability.

Active sales performances representing solid market demand

We have witnessed strong market demand for Plant 4 through sales activities, and we have stretched to complete Plant 5 construction within 24 months in order to meet additional client expectations on time. Plant 5 sales are actively progressing as an extension of Plant 4 pre-sales operations. As a result, the cumulative contract amount has surpassed USD 11.3 billion, and we have secured 14 of the global top 20 biopharmaceutical companies as our clients. We will continue to strengthen our leadership based on our main competitive advantages including speed, operational excellence, and quality.

Investment to ensure competitiveness in ADC

Samsung Biologics is strengthening investment activities to ensure our competitive advantage in the ADC (Antibody-Drug Conjugate) area, which is widely recognized as the next-generation biotechnology, and to respond to market demand on time. We are developing our own ADC conjugation facility for its operation in 2024, in addition to investing in promising biotechnology companies with proprietary ADC technologies through the Samsung Life Science Fund. Following our investment in April in Araris Biotech (Switzerland), which has cutting-edge expertise in ADC linker and conjugation, we have joined a strategic investment in AimedBio in September and are pursuing a research collaboration centered around ADC Toolbox co-development. Our investment in AimedBio holds significance because it is our first investment in a domestic biotech company with proprietary technology. Likewise, we plan to gain competitiveness in ADC business effectively through various investments in companies with advanced technologies, in addition to having our proprietary ADC conjugation facility.

Biosimilar business on track

Our subsidiary, Samsung Bioepis is also expanding its business by focusing on pipeline development. With product sales steadily increasing due to higher prescription rate for existing products and new product launches, we also expanded coverage for Epysqli (a biosimilar product referencing Soliris, SB12), launched in the EU and for Hadlima (a biosimilar product referencing Humira, SB5), launched in the U.S last July. In addition, we released phase 3 clinical data for Stelara biosimilar (SB17), an autoimmune disease treatment, and entered into a commercialization agreement with one of the global biopharmaceutical companies named Sandoz. We will continue to develop and provide patients with high-quality biosimilar products with bioequivalence to the original products.

Constant efforts to develop a more sustainable future

As a leading company to promote sustainability management for the CDMO industry, Samsung Biologics is making constant efforts to contribute to a more sustainable future. As the company chairing the supply chain sector of the Sustainable Markets Initiative Health Systems Task Force, led by His Majesty King Charles III, we have published an Open Letter, co-signed by the members of SMI Healthcare Systems Task Force including AZ, GSK, and Sanofi. The letter outlines 8 actions urging suppliers to commit to the sustainability targets to achieve Net Zero in the bio-industry. This letter underscores our unwavering commitment to achieving Net Zero as soon as possible. In addition, we joined the Sustainable Aviation Buyers Alliance in September this year to promote investments in Sustainable Aviation Fuel (SAF) and offset carbon emissions in travel and logistics. Samsung Biologics will continue to nurture our core while developing and growing to meet the expectations of our shareholders. Your continued interest and support for our business is greatly appreciated. Thank you.

October 25, 2023 President & CEO, Samsung Biologics John Rim

- CDO

- CGMP

- ADC

- Bio Campus

- IR

- CMO