CEO IR NEWSLETTER Driven. For Life. SAMSUNG BIOLOGICS 2023. 07

IR Newsletter

Dear investors, This is John Rim from Samsung Biologics. First of all, thank you for your continuous interest and support in Samsung Biologics.

Key Highlights

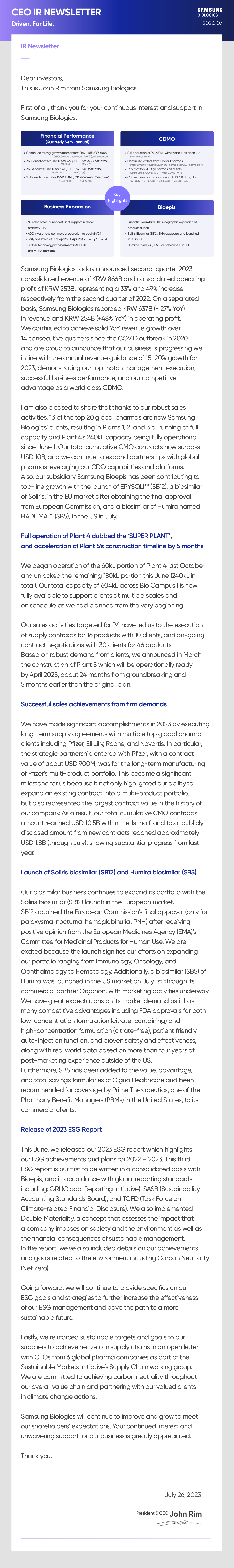

- Financial Performance (Quarterly Semi-annual)

- • Continued strong growth momentum: Rev. +41%, OP +46% * Q2 CAGR over three years ('20~23), consolidated • 2Q Consolidated: Rev. KRW 866B, OP KRW 253B (OPM: 29.3%) (+33% YoY) (+49% YoY) • 2Q Separate: Rev. KRW 637B, OP KRW 254B (OPM: 39.9%) (+27% YoY) (+48% YoY) • 1H Consolidated: Rev. KRW 1,587B, OP KRW 445B (OPM 28.0%) (+36% YOY) (+29% YoY)

- CDMO

- • Full operation of P4 240KL with Phase II initiation (Jun) *Blo Campus 1:604KL • Continued orders from Global Pharmas *Pfizer $1,080M, Novartis $391M, US Pharma $113M, EU Pharma $81M • 13 out of top 20 Big Pharmas as clients *Count Before COVID-19:3→ After COVID-19:13 • Cumulative contracts amount of USD 11.3B by Jul. **20: $6.1B → '21:$7.5B '22: $9.58 → 23 2Q: 10.5B

- Business Expansion

- • NJ sales office launched: Client support in closer proximity (Mar) • ADC investment, commercial operation to begin in '24 • Early operation of P5: Sep '25 → Apr 25 (reduced by 5 months) • Further technology improvement in S-DUAL and mRNA platform

- Bioepis

- • Lucentis Biosimilar (SB11): Geographic expansion of product launch • Soliris Biosimilar (SB12): EMA approved and launched in EU in Jul. • Humira Biosimilar (SB5): Launched in US in Jul.

Samsung Biologics today announced second-quarter 2023 consolidated revenue of KRW 866B and consolidated operating profit of KRW 253B, representing a 33% and 49% increase respectively from the second quarter of 2022. On a separated basis, Samsung Biologics recorded KRW 637B (+ 27% YoY) in revenue and KRW 254B (+48% YoY) in operating profit. We continued to achieve solid YoY revenue growth over 14 consecutive quarters since the COVID outbreak in 2020 and are proud to announce that our business is progressing well in line with the annual revenue guidance of 15-20% growth for 2023, demonstrating our top-notch management execution, successful business performance, and our competitive advantage as a world class CDMO. I am also pleased to share that thanks to our robust sales activities, 13 of the top 20 global pharmas are now Samsung Biologics' clients, resulting in Plants 1, 2, and 3 all running at full capacity and Plant 4's 240kL capacity being fully operational since June 1. Our total cumulative CMO contracts now surpass USD 10B, and we continue to expand partnerships with global pharmas leveraging our CDO capabilities and platforms. Also, our subsidiary Samsung Bioepis has been contributing to top-line growth with the launch of EPYSQLITM (SB12), a biosimilar of Soliris, in the EU market after obtaining the final approval from European Commission, and a biosimilar of Humira named HADLIMATM (SB5), in the US in July. Full operation of Plant 4 dubbed the 'SUPER PLANT', and acceleration of Plant 5's construction timeline by 5 months We began operation of the 60KL portion of Plant 4 last October and unlocked the remaining 180KL portion this June (240KL in total). Our total capacity of 604kL across Bio Campus I is now fully available to support clients at multiple scales and on schedule as we had planned from the very beginning. Our sales activities targeted for P4 have led us to the execution of supply contracts for 16 products with 10 clients, and on-going contract negotiations with 30 clients for 46 products. Based on robust demand from clients, we announced in March the construction of Plant 5 which will be operationally ready by April 2025, about 24 months from groundbreaking and 5 months earlier than the original plan. Successful sales achievements from firm demands We have made significant accomplishments in 2023 by executing long-term supply agreements with multiple top global pharma clients including Pfizer, Eli Lilly, Roche, and Novartis. In particular, the strategic partnership entered with Pfizer, with a contract value of about USD 900M, was for the long-term manufacturing of Pfizer's multi-product portfolio. This became a significant milestone for us because it not only highlighted our ability to expand an existing contract into a multi-product portfolio, but also represented the largest contract value in the history of our company. As a result, our total cumulative CMO contracts amount reached USD 10.5B within the 1st half, and total publicly disclosed amount from new contracts reached approximately USD 1.8B (through July), showing substantial progress from last year. Launch of Soliris biosimilar (SB12) and Humira biosimilar (SB5) Our biosimilar business continues to expand its portfolio with the Soliris biosimilar (SB12) launch in the European market. SB12 obtained the European Commission's final approval (only for paroxysmal nocturnal hemoglobinuria, PNH) after receiving positive opinion from the European Medicines Agency (EMA)'s Committee for Medicinal Products for Human Use. We are excited because the launch signifies our efforts on expanding our portfolio ranging from Immunology, Oncology, and Ophthalmology to Hematology. Additionally, a biosimilar (SB5) of Humira was launched in the US market on July 1st through its commercial partner Organon, with marketing activities underway. We have great expectations on its market demand as it has many competitive advantages including FDA approvals for both low-concentration formulation (citrate-containing) and high-concentration formulation (citrate-free), patient friendly auto-injection function, and proven safety and effectiveness, along with real world data based on more than four years of post-marketing experience outside of the US. Furthermore, SB5 has been added to the value, advantage, and total savings formularies of Cigna Healthcare and been recommended for coverage by Prime Therapeutics, one of the Pharmacy Benefit Managers (PBMs) in the United States, to its commercial clients. Release of 2023 ESG Report This June, we released our 2023 ESG report which highlights our ESG achievements and plans for 2022-2023. This third ESG report is our first to be written in a consolidated basis with Bioepis, and in accordance with global reporting standards including: GRI (Global Reporting Initiative), SASB (Sustainability Accounting Standards Board), and TCFD (Task Force on Climate-related Financial Disclosure). We also implemented Double Materiality, a concept that assesses the impact that a company imposes on society and the environment as well as the financial consequences of sustainable management. In the report, we've also included details on our achievements and goals related to the environment including Carbon Neutrality (Net Zero). Going forward, we will continue to provide specifics on our ESG goals and strategies to further increase the effectiveness of our ESG management and pave the path to a more sustainable future. Lastly, we reinforced sustainable targets and goals to our suppliers to achieve net zero in supply chains in an open letter with CEOs from 6 global pharma companies as part of the Sustainable Markets Initiative's Supply Chain working group. We are committed to achieving carbon neutrality throughout our overall value chain and partnering with our valued clients in climate change actions. Samsung Biologics will continue to improve and grow to meet our shareholders' expectations. Your continued interest and unwavering support for our business is greatly appreciated. Thank you. July 26, 2023 President & CEO John Rim

CEO IR NEWSLETTER Driven. For Life. SAMSUNG BIOLOGICS 2023. 07

IR Newsletter

Dear investors, This is John Rim from Samsung Biologics. First of all, thank you for your continuous interest and support in Samsung Biologics.

Key Highlights

- Financial Performance (Quarterly Semi-annual)

- • Continued strong growth momentum: Rev. +41%, OP +46% * Q2 CAGR over three years ('20~23), consolidated • 2Q Consolidated: Rev. KRW 866B, OP KRW 253B (OPM: 29.3%) (+33% YoY) (+49% YoY) • 2Q Separate: Rev. KRW 637B, OP KRW 254B (OPM: 39.9%) (+27% YoY) (+48% YoY) • 1H Consolidated: Rev. KRW 1,587B, OP KRW 445B (OPM 28.0%) (+36% YOY) (+29% YoY)

- CDMO

- • Full operation of P4 240KL with Phase II initiation (Jun) *Blo Campus 1:604KL • Continued orders from Global Pharmas *Pfizer $1,080M, Novartis $391M, US Pharma $113M, EU Pharma $81M • 13 out of top 20 Big Pharmas as clients *Count Before COVID-19:3→ After COVID-19:13 • Cumulative contracts amount of USD 11.3B by Jul. **20: $6.1B → '21:$7.5B '22: $9.58 → 23 2Q: 10.5B

- Business Expansion

- • NJ sales office launched: Client support in closer proximity (Mar) • ADC investment, commercial operation to begin in '24 • Early operation of P5: Sep '25 → Apr 25 (reduced by 5 months) • Further technology improvement in S-DUAL and mRNA platform

- Bioepis

- • Lucentis Biosimilar (SB11): Geographic expansion of product launch • Soliris Biosimilar (SB12): EMA approved and launched in EU in Jul. • Humira Biosimilar (SB5): Launched in US in Jul.

Samsung Biologics today announced second-quarter 2023 consolidated revenue of KRW 866B and consolidated operating profit of KRW 253B, representing a 33% and 49% increase respectively from the second quarter of 2022. On a separated basis, Samsung Biologics recorded KRW 637B (+ 27% YoY) in revenue and KRW 254B (+48% YoY) in operating profit. We continued to achieve solid YoY revenue growth over 14 consecutive quarters since the COVID outbreak in 2020 and are proud to announce that our business is progressing well in line with the annual revenue guidance of 15-20% growth for 2023, demonstrating our top-notch management execution, successful business performance, and our competitive advantage as a world class CDMO. I am also pleased to share that thanks to our robust sales activities, 13 of the top 20 global pharmas are now Samsung Biologics' clients, resulting in Plants 1, 2, and 3 all running at full capacity and Plant 4's 240kL capacity being fully operational since June 1. Our total cumulative CMO contracts now surpass USD 10B, and we continue to expand partnerships with global pharmas leveraging our CDO capabilities and platforms. Also, our subsidiary Samsung Bioepis has been contributing to top-line growth with the launch of EPYSQLITM (SB12), a biosimilar of Soliris, in the EU market after obtaining the final approval from European Commission, and a biosimilar of Humira named HADLIMATM (SB5), in the US in July. Full operation of Plant 4 dubbed the 'SUPER PLANT', and acceleration of Plant 5's construction timeline by 5 months We began operation of the 60KL portion of Plant 4 last October and unlocked the remaining 180KL portion this June (240KL in total). Our total capacity of 604kL across Bio Campus I is now fully available to support clients at multiple scales and on schedule as we had planned from the very beginning. Our sales activities targeted for P4 have led us to the execution of supply contracts for 16 products with 10 clients, and on-going contract negotiations with 30 clients for 46 products. Based on robust demand from clients, we announced in March the construction of Plant 5 which will be operationally ready by April 2025, about 24 months from groundbreaking and 5 months earlier than the original plan. Successful sales achievements from firm demands We have made significant accomplishments in 2023 by executing long-term supply agreements with multiple top global pharma clients including Pfizer, Eli Lilly, Roche, and Novartis. In particular, the strategic partnership entered with Pfizer, with a contract value of about USD 900M, was for the long-term manufacturing of Pfizer's multi-product portfolio. This became a significant milestone for us because it not only highlighted our ability to expand an existing contract into a multi-product portfolio, but also represented the largest contract value in the history of our company. As a result, our total cumulative CMO contracts amount reached USD 10.5B within the 1st half, and total publicly disclosed amount from new contracts reached approximately USD 1.8B (through July), showing substantial progress from last year. Launch of Soliris biosimilar (SB12) and Humira biosimilar (SB5) Our biosimilar business continues to expand its portfolio with the Soliris biosimilar (SB12) launch in the European market. SB12 obtained the European Commission's final approval (only for paroxysmal nocturnal hemoglobinuria, PNH) after receiving positive opinion from the European Medicines Agency (EMA)'s Committee for Medicinal Products for Human Use. We are excited because the launch signifies our efforts on expanding our portfolio ranging from Immunology, Oncology, and Ophthalmology to Hematology. Additionally, a biosimilar (SB5) of Humira was launched in the US market on July 1st through its commercial partner Organon, with marketing activities underway. We have great expectations on its market demand as it has many competitive advantages including FDA approvals for both low-concentration formulation (citrate-containing) and high-concentration formulation (citrate-free), patient friendly auto-injection function, and proven safety and effectiveness, along with real world data based on more than four years of post-marketing experience outside of the US. Furthermore, SB5 has been added to the value, advantage, and total savings formularies of Cigna Healthcare and been recommended for coverage by Prime Therapeutics, one of the Pharmacy Benefit Managers (PBMs) in the United States, to its commercial clients. Release of 2023 ESG Report This June, we released our 2023 ESG report which highlights our ESG achievements and plans for 2022-2023. This third ESG report is our first to be written in a consolidated basis with Bioepis, and in accordance with global reporting standards including: GRI (Global Reporting Initiative), SASB (Sustainability Accounting Standards Board), and TCFD (Task Force on Climate-related Financial Disclosure). We also implemented Double Materiality, a concept that assesses the impact that a company imposes on society and the environment as well as the financial consequences of sustainable management. In the report, we've also included details on our achievements and goals related to the environment including Carbon Neutrality (Net Zero). Going forward, we will continue to provide specifics on our ESG goals and strategies to further increase the effectiveness of our ESG management and pave the path to a more sustainable future. Lastly, we reinforced sustainable targets and goals to our suppliers to achieve net zero in supply chains in an open letter with CEOs from 6 global pharma companies as part of the Sustainable Markets Initiative's Supply Chain working group. We are committed to achieving carbon neutrality throughout our overall value chain and partnering with our valued clients in climate change actions. Samsung Biologics will continue to improve and grow to meet our shareholders' expectations. Your continued interest and unwavering support for our business is greatly appreciated. Thank you. July 26, 2023 President & CEO John Rim

- CDO

- CGMP

- ADC

- Bio Campus

- IR

- CMO