Dear Investors, This is John Rim, CEO of Samsung Biologics.

First and foremost, I would like to express my sincere gratitude and appreciation towards your continued interest and ongoing trust in Samsung Biologics over the past year. In 2022, Samsung Biologics achieved all of its annual targets in existing business divisions and successfully expanded its business scope for long-term, sustainable growth of the company.

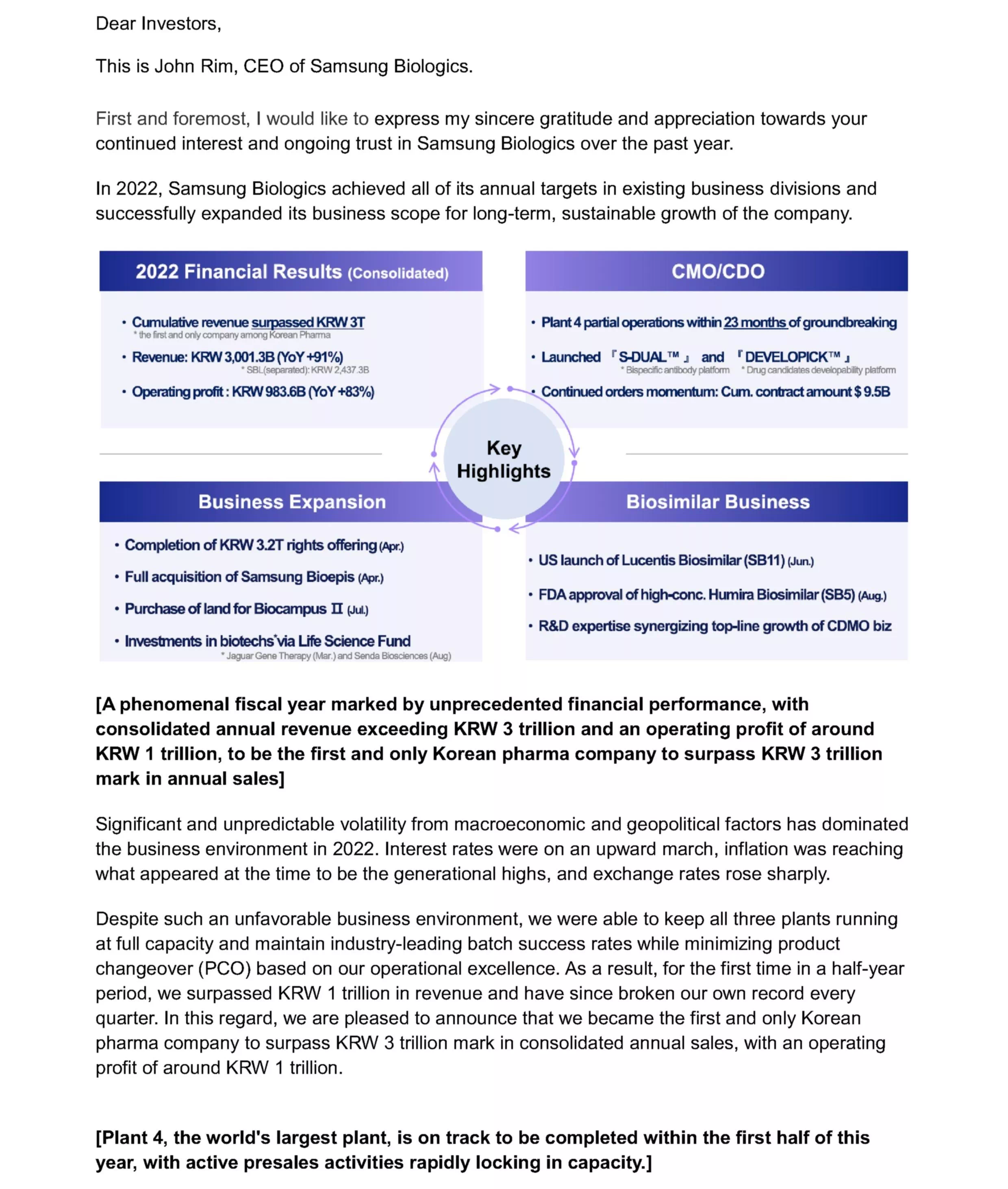

- 2022 Financial Results (Consolidated)

- Cumulative revenue surpassed KRW 3T *the first and only company among Korean Pharma Revenue: KRW 3,001.3B (YoY +91%) *SBL(separated): KRW 2,437.3B Operating profit: KRW 983.6B (YoY +83%)

- CMO/CDO

- Plant 4 partial operations within 23 months of groundbreaking Launched "S-DUALTM and 'DEVELOPICKTM' * Bispecific antibody platform * Drug candidates developability platform Continued orders momentum: Cum. contract amount $9.5B

- Business Expansion

- Completion of KRW 3.2T rights offering (Apr.) Full acquisition of Samsung Bioepis (Apr.) Purchase of land for Biocampus II (Jul.) Investments in biotechs via Life Science Fund * Jaguar Gene Therapy (Mar.) and Senda Biosciences (Aug)

- Biosimilar Business

- US launch of Lucentis Biosimilar (SB11) (Jun.) FDA approval of high-conc. Humira Biosimilar (SB5) (Aug.) R&D expertise synergizing top-line growth of CDMO biz

[A phenomenal fiscal year marked by unprecedented financial performance, with consolidated annual revenue exceeding KRW 3 trillion and an operating profit of around KRW 1 trillion, to be the first and only Korean pharma company to surpass KRW 3 trillion mark in annual sales]

Significant and unpredictable volatility from macroeconomic and geopolitical factors has dominated the business environment in 2022. Interest rates were on an upward march, inflation was reaching what appeared at the time to be the generational highs, and exchange rates rose sharply.

Despite such an unfavorable business environment, we were able to keep all three plants running at full capacity and maintain industry-leading batch success rates while minimizing product changeover (PCO) based on our operational excellence. As a result, for the first time in a half-year period, we surpassed KRW 1 trillion in revenue and have since broken our own record every quarter. In this regard, we are pleased to announce that we became the first and only Korean pharma company to surpass KRW 3 trillion mark in consolidated annual sales, with an operating profit of around KRW 1 trillion.

[Plant 4, the world's largest plant, is on track to be completed within the first half of this year, with active presales activities rapidly locking in capacity.]

Last October, Samsung Biologics began partial operations of Plant 4 (60,000 liters), the world's largest bio manufacturing site with a capacity of 240,000 liters, within 23 months after the groundbreaking, which was 6 months faster than the original 29-month timeline. It will be fully operational by the first half of this year, and presales activities have successfully locked in capacity. Prior to the plant's full ramp-up, we signed large-scale manufacturing contract agreements for 11 products with 8 global biopharmaceutical companies, and we are actively communicating with 26 other major clients on approximately 34 products. Based on our key competitive advantages of "speed" and "execution," we will strive to complete Plant 4 construction without a hitch and demonstrate our commitment to meeting client needs in a timely manner in order to solidify our trust-based partnership with our clients.

[Taking the leap to become a fully integrated global biopharmaceutical company through active investments and portfolio diversification]

In response to rising biopharmaceutical CMO demand, Samsung Biologics acquired an additional parcel of land for Bio Campus II in July, which is designed to support Samsung Biologics' further expansion of large-scale manufacturing capacity as well as house an open innovation facility to aid in the development of bio industry infrastructure. We will continue to invest in innovative venture firms both domestically and globally in order to promote and nurture promising core biotechnologies for a brighter long-term future and growth of the biopharmaceutical industry.

Since entering the CDO market in 2018, Samsung Biologics has been steadily laying the groundwork for its CDO business by establishing an independent bio research lab for next generation technology and launching proprietary technology platforms including 'S-DUALTMM (bispecific antibody platform)' and 'DEVELOPICKTM (developability assessment platform).' Samsung Biologics has expanded its business beyond monoclonal antibodies to meet a variety of industry needs. For example, in August, we successfully completed our first commercial scale engineering run for mRNA vaccine drug substance, and we are now fully equipped to provide one- stop, end-to-end services for mRNA vaccines in addition to our flagship CMO services for antibody drugs. Also, we recently announced our plan to kick off antibody-drug conjugate manufacturing. We will construct ADC conjugation facilities this year, with the goal of starting production in the first quarter of 2024.

In addition, we made our first investment in Jaguar Gene Therapy, a US biotech, in March of last year through the Samsung Life Science Fund, a joint venture established with Samsung C&T, followed in August by a $15M investment in Senda Biosciences, a US therapeutics platform company that specializes in leveraging nanoparticles to deliver protein and peptide therapies.

Furthermore, Samsung Biologics purchased Biogen's shares in Samsung Bioepis last April in order to achieve its long-term vision of becoming a global top-tier biopharma. The purchase was paid for with a portion of a KRW 3.2 trillion paid-in capital increase raised by issuing new shares, the proceeds of which will be used to fund the company's strategic growth plans.

We believe that this acquisition provides Samsung Bioepis with greater autonomy and agility in business operations, accelerating sales growth, improving operating margins, and leveraging

manufacturing excellence to drive top-line growth for both Samsung Biologics and Bioepis. Also, with the FDA's approval of the high-concentration version of Hadlima (SB5), the biosimilar referencing Humira that is set to launch in July, we have become the only company to have both low- and high-concentration versions of Humira biosimilar. This, we believe, is a critical step toward gaining a competitive advantage in the Humira biosimilar market.

[Leading ESG CDMO committed to biopharma industry's sustainable growth]

Samsung Biologics also established industry leadership in ESG management in 2022. We

January 27, 2023

John Rim

President & CEO, Samsung Biologics

Dear Investors, This is John Rim, CEO of Samsung Biologics.

First and foremost, I would like to express my sincere gratitude and appreciation towards your continued interest and ongoing trust in Samsung Biologics over the past year. In 2022, Samsung Biologics achieved all of its annual targets in existing business divisions and successfully expanded its business scope for long-term, sustainable growth of the company.

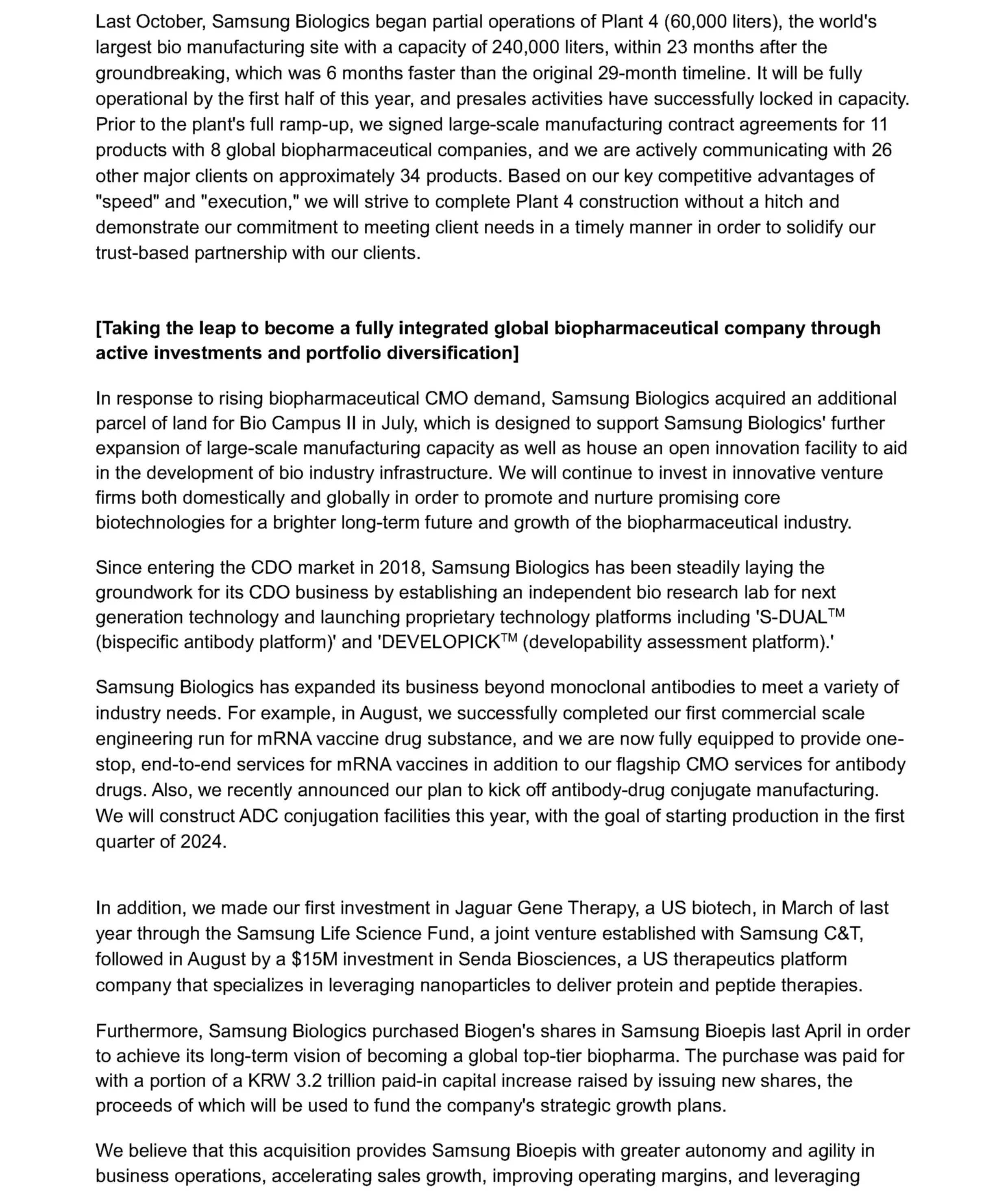

- 2022 Financial Results (Consolidated)

- Cumulative revenue surpassed KRW 3T *the first and only company among Korean Pharma Revenue: KRW 3,001.3B (YoY +91%) *SBL(separated): KRW 2,437.3B Operating profit: KRW 983.6B (YoY +83%)

- CMO/CDO

- Plant 4 partial operations within 23 months of groundbreaking Launched "S-DUALTM and 'DEVELOPICKTM' * Bispecific antibody platform * Drug candidates developability platform Continued orders momentum: Cum. contract amount $9.5B

- Business Expansion

- Completion of KRW 3.2T rights offering (Apr.) Full acquisition of Samsung Bioepis (Apr.) Purchase of land for Biocampus II (Jul.) Investments in biotechs via Life Science Fund * Jaguar Gene Therapy (Mar.) and Senda Biosciences (Aug)

- Biosimilar Business

- US launch of Lucentis Biosimilar (SB11) (Jun.) FDA approval of high-conc. Humira Biosimilar (SB5) (Aug.) R&D expertise synergizing top-line growth of CDMO biz

[A phenomenal fiscal year marked by unprecedented financial performance, with consolidated annual revenue exceeding KRW 3 trillion and an operating profit of around KRW 1 trillion, to be the first and only Korean pharma company to surpass KRW 3 trillion mark in annual sales]

Significant and unpredictable volatility from macroeconomic and geopolitical factors has dominated the business environment in 2022. Interest rates were on an upward march, inflation was reaching what appeared at the time to be the generational highs, and exchange rates rose sharply.

Despite such an unfavorable business environment, we were able to keep all three plants running at full capacity and maintain industry-leading batch success rates while minimizing product changeover (PCO) based on our operational excellence. As a result, for the first time in a half-year period, we surpassed KRW 1 trillion in revenue and have since broken our own record every quarter. In this regard, we are pleased to announce that we became the first and only Korean pharma company to surpass KRW 3 trillion mark in consolidated annual sales, with an operating profit of around KRW 1 trillion.

[Plant 4, the world's largest plant, is on track to be completed within the first half of this year, with active presales activities rapidly locking in capacity.]

Last October, Samsung Biologics began partial operations of Plant 4 (60,000 liters), the world's largest bio manufacturing site with a capacity of 240,000 liters, within 23 months after the groundbreaking, which was 6 months faster than the original 29-month timeline. It will be fully operational by the first half of this year, and presales activities have successfully locked in capacity. Prior to the plant's full ramp-up, we signed large-scale manufacturing contract agreements for 11 products with 8 global biopharmaceutical companies, and we are actively communicating with 26 other major clients on approximately 34 products. Based on our key competitive advantages of "speed" and "execution," we will strive to complete Plant 4 construction without a hitch and demonstrate our commitment to meeting client needs in a timely manner in order to solidify our trust-based partnership with our clients.

[Taking the leap to become a fully integrated global biopharmaceutical company through active investments and portfolio diversification]

In response to rising biopharmaceutical CMO demand, Samsung Biologics acquired an additional parcel of land for Bio Campus II in July, which is designed to support Samsung Biologics' further expansion of large-scale manufacturing capacity as well as house an open innovation facility to aid in the development of bio industry infrastructure. We will continue to invest in innovative venture firms both domestically and globally in order to promote and nurture promising core biotechnologies for a brighter long-term future and growth of the biopharmaceutical industry.

Since entering the CDO market in 2018, Samsung Biologics has been steadily laying the groundwork for its CDO business by establishing an independent bio research lab for next generation technology and launching proprietary technology platforms including 'S-DUALTMM (bispecific antibody platform)' and 'DEVELOPICKTM (developability assessment platform).' Samsung Biologics has expanded its business beyond monoclonal antibodies to meet a variety of industry needs. For example, in August, we successfully completed our first commercial scale engineering run for mRNA vaccine drug substance, and we are now fully equipped to provide one- stop, end-to-end services for mRNA vaccines in addition to our flagship CMO services for antibody drugs. Also, we recently announced our plan to kick off antibody-drug conjugate manufacturing. We will construct ADC conjugation facilities this year, with the goal of starting production in the first quarter of 2024.

In addition, we made our first investment in Jaguar Gene Therapy, a US biotech, in March of last year through the Samsung Life Science Fund, a joint venture established with Samsung C&T, followed in August by a $15M investment in Senda Biosciences, a US therapeutics platform company that specializes in leveraging nanoparticles to deliver protein and peptide therapies.

Furthermore, Samsung Biologics purchased Biogen's shares in Samsung Bioepis last April in order to achieve its long-term vision of becoming a global top-tier biopharma. The purchase was paid for with a portion of a KRW 3.2 trillion paid-in capital increase raised by issuing new shares, the proceeds of which will be used to fund the company's strategic growth plans.

We believe that this acquisition provides Samsung Bioepis with greater autonomy and agility in business operations, accelerating sales growth, improving operating margins, and leveraging

manufacturing excellence to drive top-line growth for both Samsung Biologics and Bioepis. Also, with the FDA's approval of the high-concentration version of Hadlima (SB5), the biosimilar referencing Humira that is set to launch in July, we have become the only company to have both low- and high-concentration versions of Humira biosimilar. This, we believe, is a critical step toward gaining a competitive advantage in the Humira biosimilar market.

[Leading ESG CDMO committed to biopharma industry's sustainable growth]

Samsung Biologics also established industry leadership in ESG management in 2022. We

January 27, 2023

John Rim

President & CEO, Samsung Biologics

- CDO

- CGMP

- ADC

- Bio Campus

- IR

- CMO