CEO MESSAGE Driven. For Life.

SAMSUNG BIOLOGICS 2023. 04

IR Newsletter

Dear Investors,

This is John Rim, CEO of Samsung Biologics.

I would like to begin by expressing my deep gratitude and appreciation for your continued interest and support in Samsung Biologics.

Key Highlights

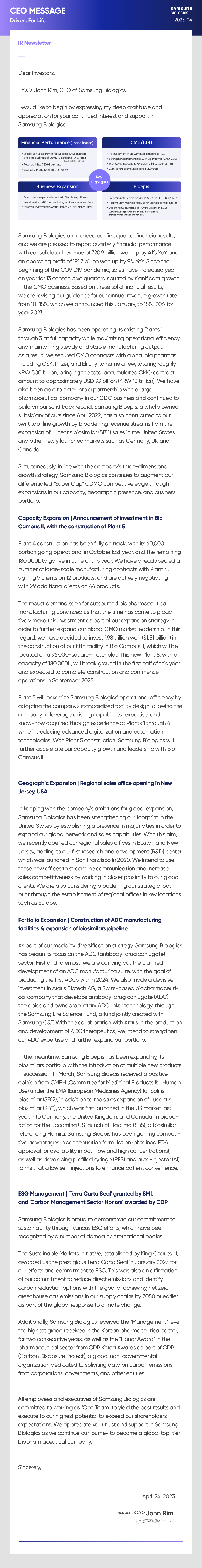

- Financial Performance (Consolidated)

- • Steady YoY Sales growth for 13 consecutive quarters since the outbreak of COVID 19 pandemic (Q1'20-Q1'23) CAGR at 52% (20~23)

- • Revenue: KRW 720.9B (YoY +41%) • Operating Profit: KRW 191.7B (YoY +9%)

- CMO/CDO

- • P5 investment in Bio Campus II announced (Mar.)

- • Strengthened Partnerships with Big Pharmas (CMO, CDO)

- • Won CDMO Leadership Awards in all 6 Categories (Feb.)

- • Cum. contract amount reached USD 9.9B

- Business Expansion

- • Opening of a regional sales office in New Jersey, US (Mar.)

- * Investment for ADC manufacturing facilities announced (Jan.)

- • Strategic investment in Araris Biotech via Life Science Fund

- Bioepis

- • Launching of Lucentis biosimilar (SB11) in GER, UK, CA (Mar.)

- • Positive CHMP Opinion received for Soliris biosimilar (SB12)

- • Upcoming US launching of Humira Biosimilar (SB5) (Compertitive edge gained by high & low-concentration, prefilled syringe and auto-injector, etc.)

Samsung Biologics announced our first quarter financial results, and we are pleased to report quarterly financial performance with consolidated revenue of 720.9 billion won up by 41% YoY and an operating profit of 191.7 billion won up by 9% YoY. Since the beginning of the COVID19 pandemic, sales have increased year on year for 13 consecutive quarters, spurred by significant growth in the CMO business. Based on these solid financial results, we are revising our guidance for our annual revenue growth rate from 10-15%, which we announced this January, to 15%-20% for year 2023.

Samsung Biologics has been operating its existing Plants 1 through 3 at full capacity while maximizing operational efficiency and maintaining steady and stable manufacturing output. As a result, we secured CMO contracts with global big pharmas including GSK, Pfizer, and Eli Lilly, to name a few, totaling roughly KRW 500 billion, bringing the total accumulated CMO contract amount to approximately USD 9.9 billion (KRW 13 trillion). We have also been able to enter into a partnership with a large pharmaceutical company in our CDO business and continued to build on our solid track record. Samsung Bioepis, a wholly owned subsidiary of ours since April 2022, has also contributed to our swift top-line growth by broadening revenue streams from the expansion of Lucentis biosimilar (SB11) sales in the United States, and other newly launched markets such as Germany, UK and Canada.

Simultaneously, in line with the company's three-dimensional growth strategy, Samsung Biologics continues to augment our differentiated "Super Gap" CDMO competitive edge through expansions in our capacity, geographic presence, and business portfolio.

Capacity Expansion | Announcement of investment in Bio Campus II, with the construction of Plant 5

Plant 4 construction has been fully on track, with its 60,000L portion going operational in October last year, and the remaining 180,000L to go live in June of this year. We have already sealed a number of large-scale manufacturing contracts with Plant 4, signing 9 clients on 12 products, and are actively negotiating with 29 additional clients on 44 products.

The robust demand seen for outsourced biopharmaceutical manufacturing convinced us that the time has come to proac- tively make this investment as part of our expansion strategy in order to further expand our global CMO market leadership. In this regard, we have decided to invest 1.98 trillion won ($1.51 billion) in the construction of our fifth facility in Bio Campus II, which will be located on a 96,000-square-meter plot. This new Plant 5, with a capacity of 180,000L, will break ground in the first half of this year and expected to complete construction and commence operations in September 2025.

Plant 5 will maximize Samsung Biologics' operational efficiency by adopting the company's standardized facility design, allowing the company to leverage existing capabilities, expertise, and know-how acquired through experience at Plants 1 through 4, while introducing advanced digitalization and automation technologies. With Plant 5 construction, Samsung Biologics will further accelerate our capacity growth and leadership with Bio Campus II.

Geographic Expansion | Regional sales office opening in New Jersey, USA

In keeping with the company's ambitions for global expansion, Samsung Biologics has been strengthening our footprint in the United States by establishing a presence in major cities in order to expand our global network and sales capabilities. With this aim, we recently opened our regional sales offices in Boston and New Jersey, adding to our first research and development (R&D) center which was launched in San Francisco in 2020. We intend to use these new offices to streamline communication and increase sales competitiveness by working in closer proximity to our global clients. We are also considering broadening our strategic foot- print through the establishment of regional offices in key locations such as Europe.

Portfolio Expansion | Construction of ADC manufacturing facilities & expansion of biosimilars pipeline

As part of our modality diversification strategy, Samsung Biologics has begun its focus on the ADC (antibody-drug conjugate) sector. First and foremost, we are carrying out the planned development of an ADC manufacturing suite, with the goal of producing the first ADCs within 2024. We also made a decisive investment in Araris Biotech AG, a Swiss-based biopharmaceuti- cal company that develops antibody-drug conjugate (ADC) therapies and owns proprietary ADC linker technology, through the Samsung Life Science Fund, a fund jointly created with Samsung C&T. With the collaboration with Araris in the production and development of ADC therapeutics, we intend to strengthen our ADC expertise and further expand our portfolio.

In the meantime, Samsung Bioepis has been expanding its biosimilars portfolio with the introduction of multiple new products in succession. In March, Samsung Bioepis received a positive opinion from CMPH (Committee for Medicinal Products for Human Use) under the EMA (European Medicines Agency) for Soliris biosimilar (SB12), in addition to the sales expansion of Lucentis biosimilar (SB11), which was first launched in the US market last year, into Germany, the United Kingdom, and Canada. In prepa- ration for the upcoming US launch of Hadlima (SB5), a biosimilar referencing Humira, Samsung Bioepis has been gaining competi- tive advantages in concentration formulation (obtained FDA approval for availability in both low and high concentrations), as well as developing prefilled syringe (PFS) and auto-injector (Al) forms that allow self-injections to enhance patient convenience.

ESG Management | 'Terra Carta Seal' granted by SMI, and 'Carbon Management Sector Honors' awarded by CDP

Samsung Biologics is proud to demonstrate our commitment to sustainability through various ESG efforts, which have been recognized by a number of domestic/international bodies.

The Sustainable Markets Initiative, established by King Charles III,

awarded us the prestigious Terra Carta Seal in January 2023 for our efforts and commitment to ESG. This was also an affirmation of our commitment to reduce direct emissions and identify carbon reduction options with the goal of achieving net zero greenhouse gas emissions in our supply chains by 2050 or earlier as part of the global response to climate change.

Additionally, Samsung Biologics received the "Management" level, the highest grade received in the Korean pharmaceutical sector, for two consecutive years, as well as the "Honor Award" in the pharmaceutical sector from CDP Korea Awards as part of CDP (Carbon Disclosure Project), a global non-governmental organization dedicated to soliciting data on carbon emissions from corporations, governments, and other entities.

All employees and executives of Samsung Biologics are committed to working as "One Team" to yield the best results and execute to our highest potential to exceed our shareholders' expectations. We appreciate your trust and support in Samsung Biologics as we continue our journey to become a global top-tier biopharmaceutical company.

Sincerely,

April 24, 2023 President & CEO John Rim

CEO MESSAGE Driven. For Life.

SAMSUNG BIOLOGICS 2023. 04

IR Newsletter

Dear Investors,

This is John Rim, CEO of Samsung Biologics.

I would like to begin by expressing my deep gratitude and appreciation for your continued interest and support in Samsung Biologics.

Key Highlights

- Financial Performance (Consolidated)

- • Steady YoY Sales growth for 13 consecutive quarters since the outbreak of COVID 19 pandemic (Q1'20-Q1'23) CAGR at 52% (20~23)

- • Revenue: KRW 720.9B (YoY +41%) • Operating Profit: KRW 191.7B (YoY +9%)

- CMO/CDO

- • P5 investment in Bio Campus II announced (Mar.)

- • Strengthened Partnerships with Big Pharmas (CMO, CDO)

- • Won CDMO Leadership Awards in all 6 Categories (Feb.)

- • Cum. contract amount reached USD 9.9B

- Business Expansion

- • Opening of a regional sales office in New Jersey, US (Mar.)

- * Investment for ADC manufacturing facilities announced (Jan.)

- • Strategic investment in Araris Biotech via Life Science Fund

- Bioepis

- • Launching of Lucentis biosimilar (SB11) in GER, UK, CA (Mar.)

- • Positive CHMP Opinion received for Soliris biosimilar (SB12)

- • Upcoming US launching of Humira Biosimilar (SB5) (Compertitive edge gained by high & low-concentration, prefilled syringe and auto-injector, etc.)

Samsung Biologics announced our first quarter financial results, and we are pleased to report quarterly financial performance with consolidated revenue of 720.9 billion won up by 41% YoY and an operating profit of 191.7 billion won up by 9% YoY. Since the beginning of the COVID19 pandemic, sales have increased year on year for 13 consecutive quarters, spurred by significant growth in the CMO business. Based on these solid financial results, we are revising our guidance for our annual revenue growth rate from 10-15%, which we announced this January, to 15%-20% for year 2023.

Samsung Biologics has been operating its existing Plants 1 through 3 at full capacity while maximizing operational efficiency and maintaining steady and stable manufacturing output. As a result, we secured CMO contracts with global big pharmas including GSK, Pfizer, and Eli Lilly, to name a few, totaling roughly KRW 500 billion, bringing the total accumulated CMO contract amount to approximately USD 9.9 billion (KRW 13 trillion). We have also been able to enter into a partnership with a large pharmaceutical company in our CDO business and continued to build on our solid track record. Samsung Bioepis, a wholly owned subsidiary of ours since April 2022, has also contributed to our swift top-line growth by broadening revenue streams from the expansion of Lucentis biosimilar (SB11) sales in the United States, and other newly launched markets such as Germany, UK and Canada.

Simultaneously, in line with the company's three-dimensional growth strategy, Samsung Biologics continues to augment our differentiated "Super Gap" CDMO competitive edge through expansions in our capacity, geographic presence, and business portfolio.

Capacity Expansion | Announcement of investment in Bio Campus II, with the construction of Plant 5

Plant 4 construction has been fully on track, with its 60,000L portion going operational in October last year, and the remaining 180,000L to go live in June of this year. We have already sealed a number of large-scale manufacturing contracts with Plant 4, signing 9 clients on 12 products, and are actively negotiating with 29 additional clients on 44 products.

The robust demand seen for outsourced biopharmaceutical manufacturing convinced us that the time has come to proac- tively make this investment as part of our expansion strategy in order to further expand our global CMO market leadership. In this regard, we have decided to invest 1.98 trillion won ($1.51 billion) in the construction of our fifth facility in Bio Campus II, which will be located on a 96,000-square-meter plot. This new Plant 5, with a capacity of 180,000L, will break ground in the first half of this year and expected to complete construction and commence operations in September 2025.

Plant 5 will maximize Samsung Biologics' operational efficiency by adopting the company's standardized facility design, allowing the company to leverage existing capabilities, expertise, and know-how acquired through experience at Plants 1 through 4, while introducing advanced digitalization and automation technologies. With Plant 5 construction, Samsung Biologics will further accelerate our capacity growth and leadership with Bio Campus II.

Geographic Expansion | Regional sales office opening in New Jersey, USA

In keeping with the company's ambitions for global expansion, Samsung Biologics has been strengthening our footprint in the United States by establishing a presence in major cities in order to expand our global network and sales capabilities. With this aim, we recently opened our regional sales offices in Boston and New Jersey, adding to our first research and development (R&D) center which was launched in San Francisco in 2020. We intend to use these new offices to streamline communication and increase sales competitiveness by working in closer proximity to our global clients. We are also considering broadening our strategic foot- print through the establishment of regional offices in key locations such as Europe.

Portfolio Expansion | Construction of ADC manufacturing facilities & expansion of biosimilars pipeline

As part of our modality diversification strategy, Samsung Biologics has begun its focus on the ADC (antibody-drug conjugate) sector. First and foremost, we are carrying out the planned development of an ADC manufacturing suite, with the goal of producing the first ADCs within 2024. We also made a decisive investment in Araris Biotech AG, a Swiss-based biopharmaceuti- cal company that develops antibody-drug conjugate (ADC) therapies and owns proprietary ADC linker technology, through the Samsung Life Science Fund, a fund jointly created with Samsung C&T. With the collaboration with Araris in the production and development of ADC therapeutics, we intend to strengthen our ADC expertise and further expand our portfolio.

In the meantime, Samsung Bioepis has been expanding its biosimilars portfolio with the introduction of multiple new products in succession. In March, Samsung Bioepis received a positive opinion from CMPH (Committee for Medicinal Products for Human Use) under the EMA (European Medicines Agency) for Soliris biosimilar (SB12), in addition to the sales expansion of Lucentis biosimilar (SB11), which was first launched in the US market last year, into Germany, the United Kingdom, and Canada. In prepa- ration for the upcoming US launch of Hadlima (SB5), a biosimilar referencing Humira, Samsung Bioepis has been gaining competi- tive advantages in concentration formulation (obtained FDA approval for availability in both low and high concentrations), as well as developing prefilled syringe (PFS) and auto-injector (Al) forms that allow self-injections to enhance patient convenience.

ESG Management | 'Terra Carta Seal' granted by SMI, and 'Carbon Management Sector Honors' awarded by CDP

Samsung Biologics is proud to demonstrate our commitment to sustainability through various ESG efforts, which have been recognized by a number of domestic/international bodies.

The Sustainable Markets Initiative, established by King Charles III,

awarded us the prestigious Terra Carta Seal in January 2023 for our efforts and commitment to ESG. This was also an affirmation of our commitment to reduce direct emissions and identify carbon reduction options with the goal of achieving net zero greenhouse gas emissions in our supply chains by 2050 or earlier as part of the global response to climate change.

Additionally, Samsung Biologics received the "Management" level, the highest grade received in the Korean pharmaceutical sector, for two consecutive years, as well as the "Honor Award" in the pharmaceutical sector from CDP Korea Awards as part of CDP (Carbon Disclosure Project), a global non-governmental organization dedicated to soliciting data on carbon emissions from corporations, governments, and other entities.

All employees and executives of Samsung Biologics are committed to working as "One Team" to yield the best results and execute to our highest potential to exceed our shareholders' expectations. We appreciate your trust and support in Samsung Biologics as we continue our journey to become a global top-tier biopharmaceutical company.

Sincerely,

April 24, 2023 President & CEO John Rim

- CDO

- CGMP

- ADC

- Bio Campus

- IR

- CMO